Lobal Gold Prices Today – September 22, 2025

Gold prices rose significantly today, reflecting a strong upward trend in the global market. Investors are watching closely as XAU/USD hits new highs.

China’s Cyberspace Administration (CAC) has barred major domestic technology companies from purchasing artificial intelligence (AI) chips from Nvidia, in a move aimed at strengthening the local semiconductor industry and enhancing the country’s ability to compete with the United States in the global AI race.

According to the Financial Times, the regulator informed companies including ByteDance and Alibaba to halt testing and orders for the RTX Pro 6000D, a chip designed by Nvidia specifically for the Chinese market.

Several firms had planned to purchase tens of thousands of these units and had already begun testing with Nvidia’s server suppliers. However, these plans were suspended following the new government directive.

The new ban goes beyond earlier restrictions, which focused primarily on the H20 chip, another Nvidia product tailored for China. Regulators now believe that locally developed processors have reached performance levels comparable to the U.S.-approved Nvidia models available in the Chinese market.

Nvidia CEO Jensen Huang expressed disappointment, stating that the company can only operate in markets where governments allow it. He acknowledged the broader geopolitical agendas between China and the United States but emphasized patience in handling the situation.

China is pushing its tech giants to rely less on Nvidia and instead support domestic semiconductor firms. Regulators recently summoned local chipmakers such as Huawei and Cambricon, along with tech leaders Alibaba and Baidu, to compare their processors against Nvidia’s China-only products.

Evaluations reportedly concluded that some Chinese AI processors have already matched, and in certain cases surpassed, Nvidia’s permitted chips.

Reports suggest Chinese chipmakers are working to triple AI chip production by next year, signaling a significant step toward self-sufficiency in the sector.

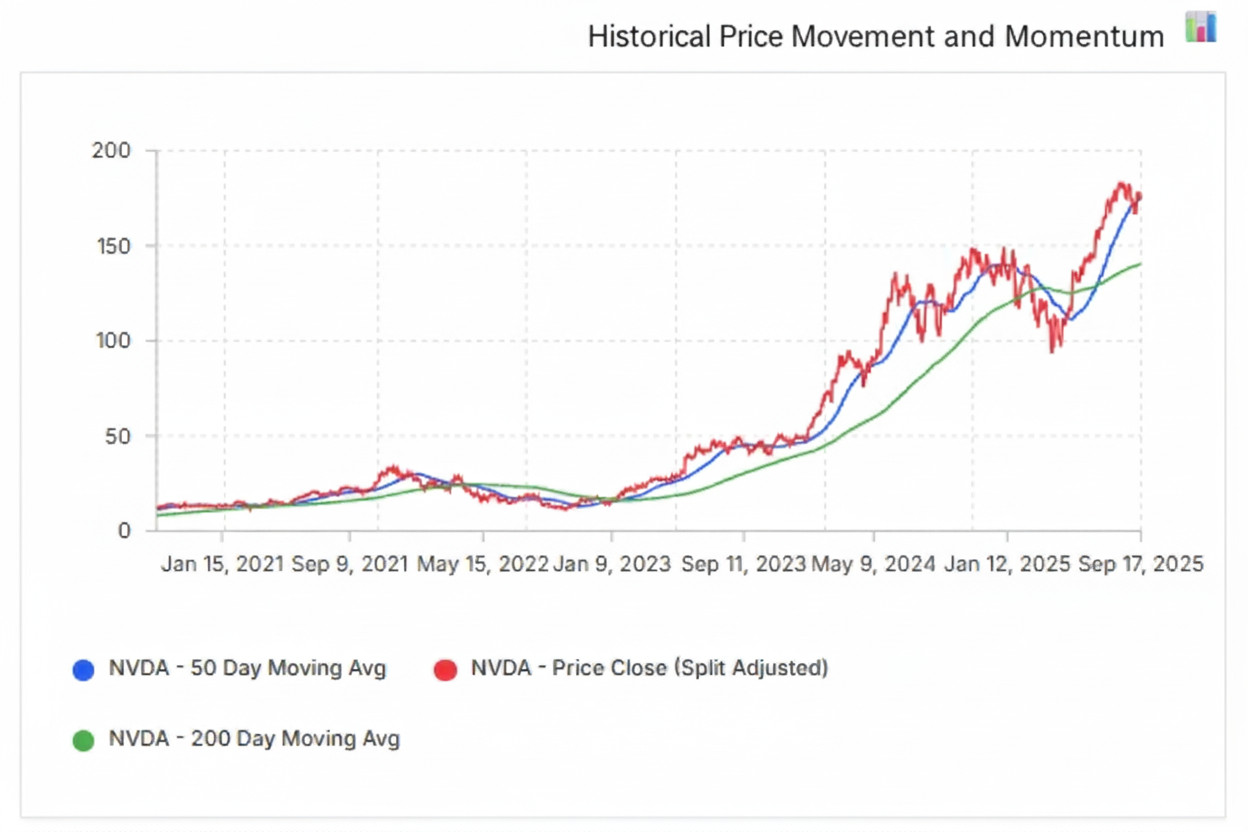

Following the ban, Nvidia’s stock traded at $174.88, marking a daily decline of 1.6%. Despite the short-term drop, the stock remains close to its all-time high of $184.48 reached in August 2025, and is still up more than 200% from its yearly low.

In the short run, Nvidia may face headwinds due to Beijing’s restrictions. However, strong global demand for AI technologies continues to support the company’s long-term growth prospects.

Gold prices rose significantly today, reflecting a strong upward trend in the global market. Investors are watching closely as XAU/USD hits new highs.

Elon Musk’s xAI aims to raise $20 billion in equity and debt, securing Nvidia’s GPUs and investment to power its growing AI infrastructure.

Apple has ramped up production of the iPhone 17 after stronger-than-expected pre-orders. Consumers are showing a clear preference for the $799 base model over …

Gold prices dipped slightly today, with the ounce trading at $3,646.47 after a 0.36% decline. Despite the drop, gold remains a key safe-haven asset …

Ethereum sees major movements as four new wallets withdraw over $340M from Kraken, signaling long-term holding. Market trends and technical indicators suggest potential bullish …

Gold prices edged higher today, reflecting investor caution amid ongoing market volatility. The precious metal continues to serve as a safe-haven asset against global …