Gold prices slipped modestly on Thursday but continued to hover close to historic highs as global markets turned their attention to key U.S. inflation figures due later in the day. The slight pullback followed weaker-than-expected producer price data, which strengthened investor confidence that the Federal Reserve may move toward cutting interest rates as soon as next week.

Analysts explained that gold is currently in a consolidation phase after its recent rally, with traders waiting for the consumer price index report to gauge the Fed’s next steps. A stronger inflation reading could give the U.S. dollar short-term support and place temporary pressure on gold. However, many market participants believe losses would likely remain limited, as the broader expectation of monetary easing still dominates sentiment.

The labor market has also added weight to the case for rate cuts. Nonfarm payrolls data released last week came in weaker than anticipated, and significant revisions revealed that the U.S. economy lost 911,000 jobs in the twelve months through March. Weekly jobless claims, set for release alongside the inflation data, are also expected to provide further clues about the health of the job market.

Markets widely anticipate that the Fed will reduce interest rates by 25 basis points at its meeting next Wednesday, though some investors see a small chance of a larger 50-point cut. Lower borrowing costs tend to favor gold, as the non-yielding metal becomes more attractive compared to interest-bearing assets.

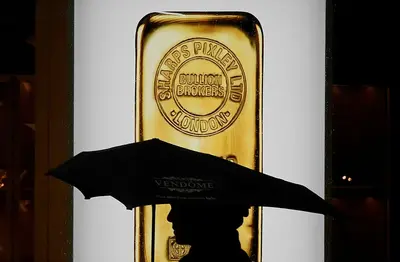

On Wednesday, December gold futures settled at $3,682 per ounce, while spot prices last traded at $3,632.48, down 0.2% after reaching an all-time high of $3,673.95 earlier in the week. U.S. gold futures also fell 0.3% to $3,669.80. In contrast, the U.S. dollar index edged higher by 0.1%, partially offsetting demand for the metal.

In the broader precious metals market, silver slipped 0.3% to $41.07 per ounce, platinum eased 0.2% to $1,383.10, while palladium rose 0.3% to $1,175.86. These moves highlight the ongoing volatility across commodities as investors balance inflation risks, interest rate expectations, and currency movements.

Despite the short-term fluctuations, many analysts believe the long-term outlook for gold remains bullish, especially if central banks continue to shift toward looser monetary policy in response to global economic uncertainties.